4 Tips to Help You Save Money in the New Year

Your 2017 New Year’s resolution: Get serious about saving for your long-term financial goals. Maybe you’re this close to paying off student loans, or you’ve been dreaming about a summer getaway. Whatever your needs are, all you have to do to put these unique savings ideas into practice is get started – and stick with it. This will be one resolution you won’t want to break!

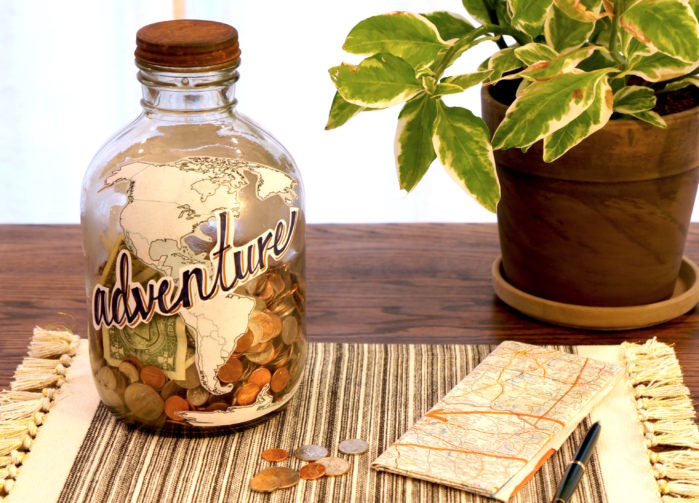

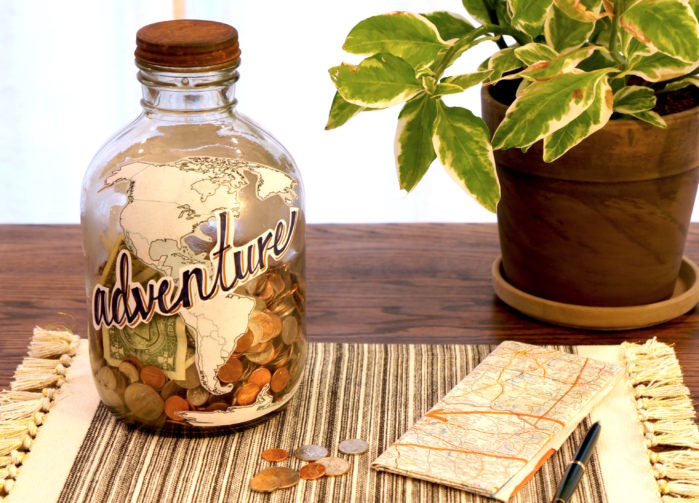

No. 1: Money Jar Method

This easy-to-follow plan will have you saving more than $1,300 by this time next year! Here’s how it works: grab a large jar or vessel (we added a map and inspirational lettering to ours) and start your first week by depositing a dollar. Add an additional dollar every week you save. Start small and ease your way into saving big money.

For example:

Week 1 = save $1

Week 2 = add $2

Week 3 = add $3

And so on. The last week of the year you’ll add $52. You’ll have saved more than $1,300! If you choose a glass jar, you’ll have fun watching the physical mass of your money grow. The folks at frugalbeautiful.com offer a handy chart to keep track of your savings. At the end of 52 weeks, you’ll have saved enough for a fun vacation. Go you!

*An alternative to this plan is to simply deposit all loose change you receive, every day, into a jar. Each day will vary, but you’ll be adding change every single day. Of course, you’ll have to move away from your debit card, which bring us to the Envelope System.

No. 2: Envelope System

This saving method requires some upfront planning, but it will make you aware of your spending habits (and afford you the ability to change them). You’ll think about what you’re spending your money on, therefore increasing your chances of curbing spending where you can.

Know your bills: Before you start, know what your fixed bills are (rent or mortgage, child care, utilities, etc.) and determine what’s available after they’re paid. Once you know how much money is left, identify the additional things you spend money on: Groceries, gas, entertainment, gym memberships, that sort of thing.

Stuff envelopes with cash: Create an envelope for each category you’ve identified and write the category name on the front. After each paycheck, put in the budgeted amount in cash. We cut and taped an old map and lettered the envelope fronts. Accordion envelopes work too, but know you’ll probably grab your envelope and go. They should fit in your pocket or bag.

Cash only: Pay ONLY cash for groceries, entertainment, etc. Once you run out of cash in an envelope, you’ve reached your budget in that pay period and should refrain from spending any more in that category until your next pay period. Be diligent.

Take only the cash you need: An easy way to hold yourself accountable is to take ONLY what you need from each envelope on any given day. If you budgeted $200 for clothing this month and know there’s a sale on your way home, don’t bring all $200. This rule is key when there are multiple people using the same envelopes.

Leftovers: Use whatever money is left in your envelopes to pay down debt monthly, or put your extra cash into savings. Being unable to swipe a debit or charge card makes you think a little longer about what you’re spending.

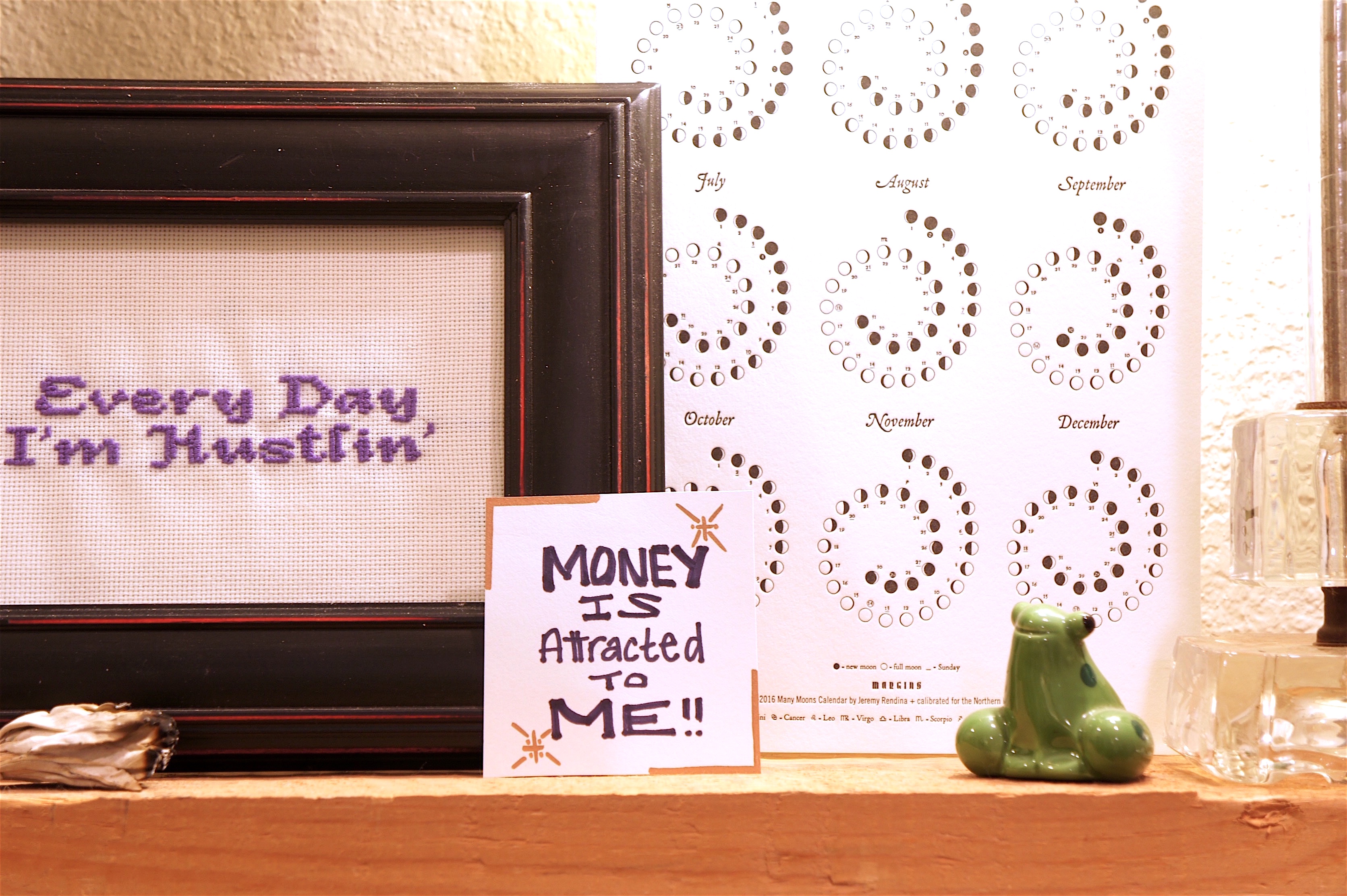

No. 3: Embrace a Money Mantra

Identifying and repeating a “money mantra” will get you in the money-saving mindset. A mantra is a word or phrase that is generally repeated during meditation. The simple act of choosing a money phrase that speaks to you, and repeating it several times a day, is based on the theory of the “law of attraction” – what you spend your thoughts and energy on is attracted back to you.

A few mantras to choose from, or create your own:

Money is attracted to me.

I am a money magnet.

I am debt free.

I am good at saving.

Say it with confidence at night and in the morning. Also try writing it down and place it in a spot you will see often.

No. 4: Pay for Bad Habits

For something a little more tangible, choose a habit you’d like to correct and pay yourself every time you repeat it. Maybe it’s a foul mouth you’d like to correct? Every time you swear (or speed, miss a deadline, lose your temper or slouch), put a predetermined amount in your jar.

If the stakes are high – say $5 for every instance – you’ll either curb your habit or amass plenty of extra cash. At the end of a few months, you’ll have saved some extra dollars and hopefully made some self-improvements.

And there you have it – a few simple, creative ways to reach your long-term goals in 2017.